FEOC compliance part 1 - US incentives: ITC , PTC, MPTC.

At RE+, the hottest of all hot topics was FEOC compliance.To break it down and understand the real implications,

I’ll be sharing a series of posts exploring how this will affect projects and reshape the BESS landscape in the coming years.

Let’s start with the foundation: current government incentives.

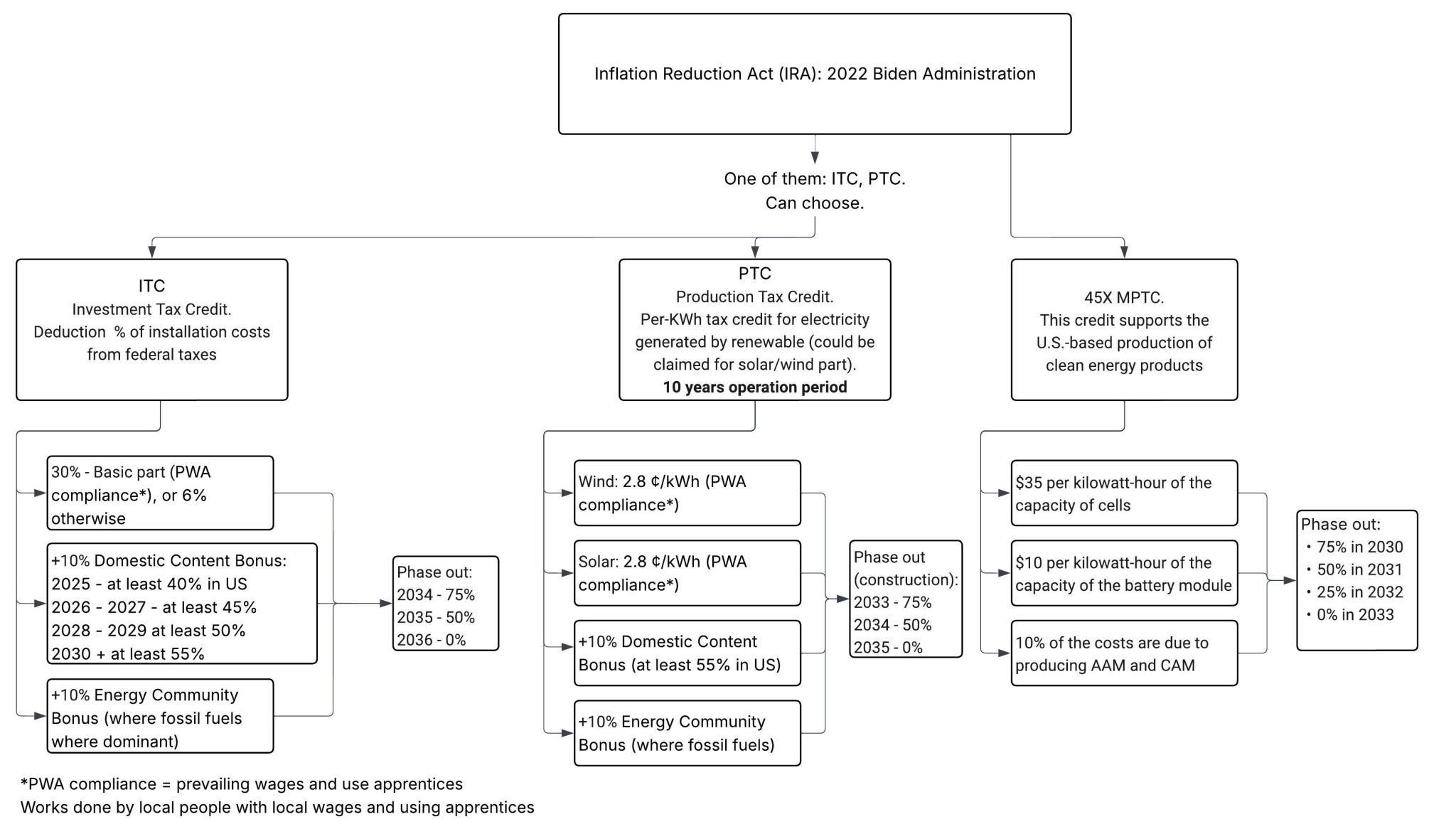

The IRA (2022, Biden Administration) created several powerful tax incentives to accelerate clean energy deployment in the U.S. Developers and manufacturers can choose between different paths depending on their projects: ITC, PTC, or 45X MPTC.

1. Investment Tax Credit (ITC)A deduction on installation costs from federal taxes.Base credit:- 30% if projects comply with Prevailing Wage & Apprenticeship (PWA) rules. Only 6% if PWA is not met.Additional bonuses:a) +10% Domestic Content Bonus:Requires a minimum share of U.S.-made components, ramping up over time:40% (2025), 45% (2026–27), 50% (2028–29), 55% (2030+).b) +10% Energy Community Bonus: Applies in communities historically tied to fossil fuels.Phase out: ITC value decreases starting in 2034, reaching 0% by 2036.

2. Production Tax Credit (PTC)A credit based on electricity generated, available for 10 years of operation.Base rate:2.8 ¢/kWh for wind or solar (with PWA compliance).Additional bonuses:+10% Domestic Content Bonus (at least 55% U.S. components).+10% Energy Community Bonus (fossil fuel communities).Phase out: For projects beginning construction after 2032, credits decline to 0% by 2035.

3. 45X Advanced Manufacturing Production Tax Credit (MPTC)Designed to boost U.S.-based clean energy manufacturing. Provides credits for producing battery and solar components:$35 per kWh of cell capacity.$10 per kWh of battery module capacity.Additional support for producing anode/cathode materials (AAM/CAM).Phase out: Gradually declines starting 2030 (75%) → 0% by 2033.

Key Point:

PWA CompliancePWA = Prevailing Wage & Apprenticeship rules.Ensures projects hire local workers at fair wages and train apprentices.Without compliance, the tax credits shrink drastically (30% → 6% ITC; or lower PTC rates).

👉 Why this matters: These incentives shape project economics and supply chain strategies. Developers must weigh ITC vs. PTC benefits or adapt strategies when they claim ITC on BESS part while keeping PTC for solar part of hybrid project. Manufacturers are incentivized to localize production. Compliance with wage, domestic content, and energy community rules can make the difference between a marginal project and a profitable one.